Despite modern innovations, we do not live in a cashless society. People still require banks and people require access to cash. Over three million consumers nationwide still rely on cash – particularly people who may be vulnerable as well as many small businesses.

In the past two years, a total of 1,391 branches have closed across the UK including here in Worthing, Goring and Arun communities. Many will agree that banking hubs and similar schemes are the solution to this growing issue.

Current legislation requires LINK, the cash machine network, to assess whether towns losing their last bank should get alternative banking services.

However, this rule prevents LINK from considering whether an area requires a new cash solution if there is a remaining bank or building society branch in town.

The current consultation, running until the 8th of February, includes a proposal to increase this threshold for intervention to activate when the 'second-to-last' bank closes.

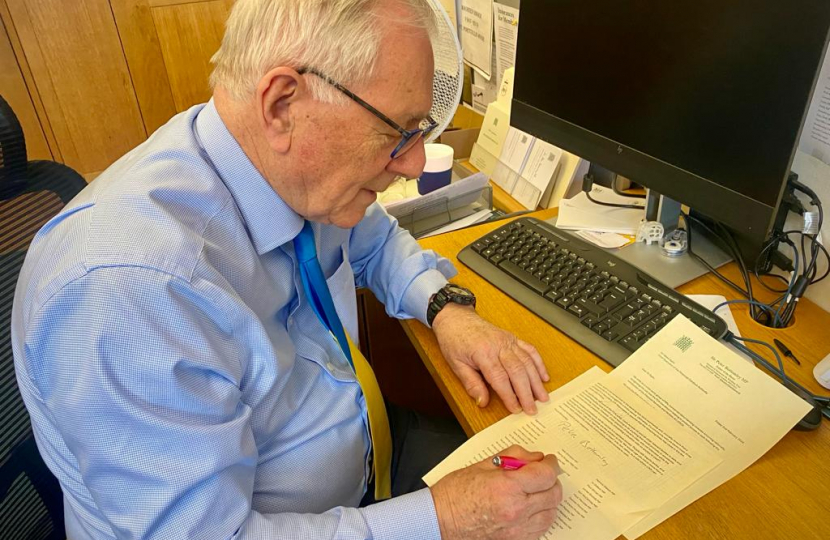

I have co-signed a letter alongside 56 other MPs to the Chief Executive of the Financial Conduct Authority. In the letter, we urge the FCA to go a step further than this and grant LINK the ability to operate on a case-by-case basis.

When the direction of travel is clear, it is better for all if the intervention is done earlier rather than later.

Such a move would allow staff to be moved over to a banking hub more seamlessly and “ensure that a community is not plunged into a limbo period” where they lose their access to cash.